Wise money management starts with creating a budget and sticking to it. A budget also helps you avoid getting into debt and avoid spending more than you make. It also means monitoring your credit history and keeping an emergency fund. The key to smart money management is to keep your expenses under control and save for emergencies. You can’t avoid unexpected expenses, but you can plan for them ahead of time. Here are some tips on how to set a budget:

Wise Money Management and Budgeting

The first step in wise money management is to create a budget. This will help you keep track of all your expenses, which include both fixed and variable expenses. You should also compare what you spend each month to what you budgeted. If you find out that you spent too much on a certain item, then you need to make adjustments. For example, you should cut back on your gym membership and dining out.

Setting up a budget will help you take control of your money and avoid debt. It will also help you plan for unforeseen expenses. By planning your monthly expenses, you can set yourself up for long-term financial success. It can also help you avoid debt and maximize your quality of life.

Another helpful tip is to use a spreadsheet. You can find spreadsheets that have pre-made templates. For example, the 50/30/20 rule spreadsheet is compatible with most spreadsheet programs. Using a spreadsheet program, you can keep track of your spending habits. Using a financial tool like a mobile app can help you reach your goals and save money.

It is important to maintain open communication with your partner when it comes to money. Open and honest conversations about finances will help you avoid conflict. If you have kids, involve them in planning and saving goals. It is important to create a family budget that covers all the essentials, such as food, housing, utilities, phones, transport, and medical services.

The process of creating a budget allows you to identify expenses and plan for them. By doing this, you can maximize your savings and invest money. This method can help you get out of debt and enjoy more freedom to spend money. For instance, a budget will help you identify unnecessary expenses and limit the amount of interest you pay on wasteful debt.

The process of budgeting does not have to be painful or cumbersome. The idea is to set aside 10% of your income every month and spend no more than that. While this may sound a bit strict, most people do not need to live on a tight budget. A budget will keep you from overspending and will help you prepare for the future.

When done properly, budgeting will allow you to meet your monthly expenses, plan for the unpredictable parts of life, and avoid getting into debt. It doesn’t have to be tedious and does not require a math degree. It will allow you to save money, reduce overspending, and take advantage of every dollar you earn.

While budgeting can be difficult, it can also be fun. The key to success is making a budget that fits your situation. You can make a budget with your partner or spouse if you choose. This way, you can hold each other accountable for spending.

Build an Emergency Fund

An emmergency fund is a necessity and there are several reasons to build an emergency fund. First, it will help you in the event of a severe financial emergency. However, you must know how to handle it to ensure that you don’t run out of money before your next paycheck. If you’re going to put all your savings in an emergency fund, you should choose an account that earns interest and allows for withdrawals without penalty.

Next, you should figure out how much money you spend each month and how much you earn. This will help you set a realistic goal for how much you need to save. It will also help you know where to cut your expenses to save more money for emergencies. A simple method for this is to track every single transaction you make throughout the month.

An emergency fund provides peace of mind during an unexpected financial emergency. Having a financial cushion is essential in a time of need, and it can prevent you from going further into debt or jeopardizing relationships. It is also important as part of your long-term investment strategy. Without an emergency fund, you may find yourself liquidating your investments because you don’t have enough money.

In addition to building an emergency fund, you should be prepared to pay off any debt. The sooner you pay off your debt, the easier it will be to manage your money in a crisis. Besides, paying off your debt is cheaper in the long run.

Avoid Debt

One of the most important points about debt prevention is to track your spending. This way, you can make sure you aren’t paying more than you have to. It’s also important to make sure you prioritize your debts and rank them according to their size and interest rate. Once you have this information, you can begin to plan how to pay off your debts.

Paying off debt is an important part of wise money management, but it can be difficult. Often it interferes with other financial goals, such as retirement savings, but by taking a focused approach, you can get the job done and save in the long run. Debt is money that you owe to another entity, often a bank, creditor, or lender. You owe this money with the expectation of repaying it, usually over a period of time with interest. Debt can be categorized into two types: unsecured debt and secured debt.

Those with high-interest debt should start by transferring a small amount from their checking account to a savings account. Even if it’s only $20 a month, this will add up to a considerable dent in future emergency expenses. This will also help to create a savings habit.

While it’s true that paying off debt is an essential part of wise money management, many people overlook the importance of savings. It is important to save money, especially for emergencies. Even if it’s hard to make ends meet, paying off debt and building emergency savings can help you avoid having to take out a loan in the future.

If you have a decent amount of cash set aside each month, you can set aside half of it as an emergency fund. This can cover three to six months of expenses and help you manage short-term expenses. Unexpected expenses can hamper your efforts to repay debt, such as car repairs or medical bills. Having a separate emergency fund helps spread the costs over several months.

It’s important to note that paying off debt can be a long process. However, once you have a nest egg, you can increase your saving. In addition, if you are working to save for retirement or emergencies, you can increase your payments on these accounts. It’s important to make a clear decision about what you want to achieve with your money.

Wise Money Management and Investing

In important area in wise money management is to determine your personal financial goals and determine how to achieve them. Your personal financial goals may include retirement, buying a home, or paying for college. Once you have decided on your goals, you can begin to invest to reach them. If you aren’t sure where to start, here are some helpful tips.

Wise Money Management and Saving

Learning how to save and budget is a core skill. This includes understanding the cash flow of your monthly bills, savings contributions, and debt repayments. You can do this by tracking your spending and income over a 30-day period. Then, compare what you have saved each month with what you have spent.

Setting a budget and sticking to it can help you develop healthier spending habits. Remember to keep it realistic and not stretch yourself too thin. The goal of saving money is to have an emergency fund you can use if you encounter unforeseen circumstances. This can save you from high interest debt or missed bills.

Delaying major purchases is also a great way to save money. This will prevent you from making impulse purchases and give you time to find better deals. Lastly, make sure that you and your partner are on the same page about your financial goals. It’s important to have open communication with your partner and children, and keep the discussions about money open and honest.

After determining your needs and wants, you can then begin to save. Spend half of your income on necessities and the other half on wants. If you want to save more for your retirement, you can make smaller purchases like a smaller car or stay-at-home vacations instead. By setting your priorities, you can make wiser decisions and build your retirement fund.

Monitor your Credit History

A credit report can give you an overview of your financial health. It shows the total number of credit accounts you have, their age and total debt, and how often you make late payments. It can also give you tips to improve your score categories. Most credit monitoring services are free and can be accessed by anyone who is 18 years of age or older. There are also paid upgrades available that give you in-depth analysis of your credit reports and scores.

Credit monitoring can also help you detect identity fraud and prevent surprises when applying for credit. As your credit report changes frequently, a credit monitoring service will send you alerts of any changes. For example, if your credit utilization ratio goes down, you’ll know about it before applying for a new loan. You can also customize your alerts, which means you’ll know about any key changes right away.

Several credit monitoring services are available, and you can choose the one that best suits your needs. Free plans are fast and easy to use, while paid ones are more involved. Regardless of which service you choose, you should monitor your credit history regularly to avoid fraud and other potential issues. It’s always a good idea to check your credit report before you apply for a loan, credit card, or other credit.

Some credit monitoring services offer daily updates, but others only allow you to view your credit score a few times a year. A monthly update gives you a comprehensive picture of your financial health and makes it easier to spot errors and fraudulent activity. Some credit card companies even offer a free credit report to help you monitor your credit history and make smart financial decisions.

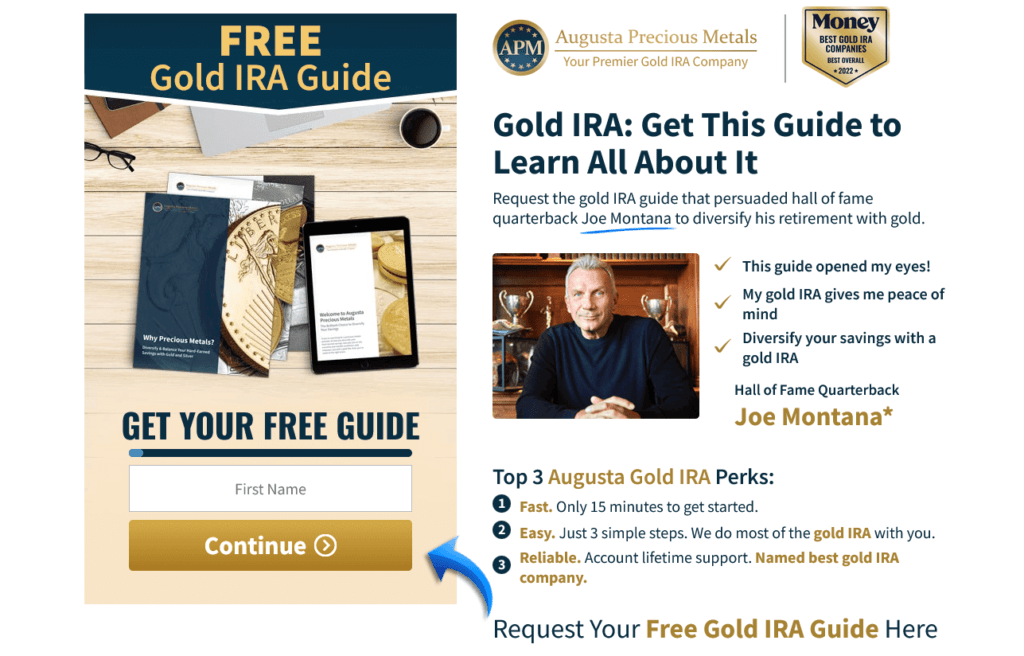

Invest in Gold

There are a number of reasons why you should invest in gold. You can buy physical gold, own shares in a gold mining company, or invest in gold exchange-traded funds. You can also invest in gold futures. Buying physical gold is the simplest method of investing, but it’s important to understand that you can expect to lose money. The value of gold is notoriously difficult to predict, so you can’t always count on the price of gold to increase.

Another reason to invest in gold is that it can help you hedge against inflation and financial crisis. Gold prices have historically increased faster than the U.S. dollar, so they are a great way to protect yourself from the risk of inflation. In addition, investors will appreciate that investing in gold can help them balance the risks of other investments by ensuring a steady return.

Although owning physical gold has some benefits, it’s not a good retirement asset. While gold can be valuable as a counterweight during times of market downturns, it should only be a small part of your portfolio. It’s also unpredictable, so you should never make it a main source of your retirement savings.

While gold has historically been volatile, it has risen along with the economy over the past two decades. However, there have been a few years when it has experienced rapid price swings. From the mid-2000s to early 2014, gold’s price rose from $400 an ounce to nearly $1,900 an ounce. In March 2022, it surged to more than $1,900 an ounce.

One of the first steps to wise money management is to determine your personal financial goals and determine how to achieve them. Your personal financial goals may include retirement, buying a home, or paying for college. Once you have decided on your goals, you can begin to invest to reach them. If you aren’t sure where to start, here are some helpful tips.

Have a Financial Management Plan

Creating a financial management plan is vital if you want to manage your money wisely. Without one, it can be difficult to know where to spend your money. To start, you should develop a budget and track your expenses. This way, you can see where you need to make adjustments to save more money, pay off debt, or invest more based on your goals.

Disclosure: We may receive a referral fee if you click on a link or image featured in this article. The content provided is not a financial advice and we recommend referring to a professional for investment advice.