Gold has been used as a form of currency and investment for centuries and it has proven to be a valuable commodity in times of economic uncertainty. When it comes to saving for retirement, there are many different options available to investors such as investing in a self-directed gold IRA. This type of account allows investors to invest in physical gold or other precious metals such a silver ot platinum.

Until recently, gold investing was not permitted in an IRA because the IRS did not consider these investments to be collectibles. However, that changed in 2007 when gold and silver coins and bullion were allowed for investment in IRAs. This change has opened a new door of opportunity for investors.

As an IRA investor, understanding the benefits of investing in Gold is very important such as tax deductibility, diversification, and Tax-free withdrawals. However, there are also risks involved as not undertsanding what is required and result in losses.

Key Benefits of a Self Directed Gold IRA Account

Gold IRA investments can provide several benefits over other types of retirement savings plans, including stability and tax advantages. It’s also a great way to diversify your retirement portfolio and hedge against inflation, debasement of currency, and economic turmoil.

If you’re looking for a way to secure your retirement savings, gold IRA investing may be right for you. Here are some key benefits of investing in gold through an IRA:

1. It is a tangible asset that can be stored and accessed easily.

2. It has been proven to hold its value over time

3. Gold is often seen as a safe haven asset during turbulent economic times.

4. Gold is globally recognized and accepted as payment.

5. It can be traded easily, which makes it a liquid asset.

6. It offers portfolio diversification potential.

7. Gold IRAs are tax-advantaged vehicles.

8. Gold IRA holders have the option to take physical delivery of their gold holdings.

9. The value of gold typically does not fluctuate as much as other investments such as stocks or bonds.

10. When it comes time to retire, you can liquidate your gold IRA and use the proceeds to fund your lifestyle needs.

As with all investments, there are advantages and disadvantages to buying gold with an IRA, as it has lower risk than paper investments.

Diversification

Diversification is a key benefit of Gold IRA investing. It gives you more flexibility in the decisions you make regarding your savings and investments. Diversification can also help you avoid the risks of a stock market crash. The COVID pandemic, which caused a dramatic decline in stock prices, also taught investors the importance of diversification, for example, while stocks suffered sharp declines, real estate experienced a boom although experts believe that the global real estate market is heading for a decline in 2023.

In addition to diversifying your portfolio, a gold IRA can also offer tax advantages. Gold IRA assets are tangible which means that you can own physical gold coins and bars and keep them safe from inflation. You can open a gold IRA account with some of the leading brokerage firms and financial institutions. A gold IRA basically allows you to diversify your investments, minimize risk, and earn more money.

Gold IRAs are not paper assets, but is a self directed account that enables you to take control of how you invest your money such as investmenting in mining, production, or precious metals. They can also include gold mutual funds or ETFs that track gold indexes. This type of investment is well-suited for long-term retirement savings and as many people don’t touch this type of asset too often, the value it offers makes it an ideal retirement asset.

When choosing the type of investments to invest in, keep in mind the risks involved. Many people choose to diversify their wealth by owning several different asset classes. While this approach does not guarantee success, it protects against the risks associated with volatile markets. For example, some assets have been profitable even when the markets are down.

Gold IRA investing comes with fees, and there are certain guidelines recommended by experts to ensure that you invest wisely. For example, many experts have recommended only investing a small percentage of your retirement account in gold and to diversify investments in other areas such as gold ETFs or stocks of gold mining companies.

Tax-deductibility

There are two types of traditional gold IRAs: the Roth and SEP gold IRAs. The Roth allows you to fund the account with after-tax dollars and the growth is tax-deductible. This means that when you retire, you will not have to pay taxes on any distributions. The SEP gold IRA is meant for business owners and self-employed individuals, and is funded with pre-tax dollars. SEP gold IRAs also allow business owners to make contributions on behalf of their employees.

If you choose to open a Gold IRA account, the fees to open and maintain the account are tax-deductible. However, there are differences between rolling over your existing IRA account to a Gold IRA. Unlike a rollover, you are required to pay taxes only on the gains from your Gold IRA and your annual fees are also tax-deductible.

The after-tax return from gold investments in a traditional IRA is significantly higher than that of investments in a brokerage account. In fact, in a traditional IRA, the annualized return from gold is nearly two times higher than that from a brokerage account. Whether you’re looking to invest in gold through a traditional IRA or a Roth IRA, it’s crucial to invest wisely and efficiently as you will want to minimize taxes, avoid unnecessary costs, and get the most out of your investment.

A Gold IRA requires a custodian which is a financial institution that manages your account. The custodian holds the gold for you and follows strict security standards. It also provides the services of purchasing gold, transporting it, and storing it. The custodian will add and remove gold to the account as requested by you. This way, you can enjoy tax-deductibility and tax benefits from your Gold IRA.

Tax-free withdrawals

You may be wondering if you can make tax-free withdrawals from Gold IRA investing. There are many steps that need to be followed in order to make withdrawals. First of all, you need to store your precious metals in an IRS-approved storage facility. This means that you can’t just store them at home, or even in a safety deposit box. It is also important to note that while you can make tax-free withdrawals while the metals are still in the IRA, once you start withdrawing them, you may be subject to penalties and taxes.

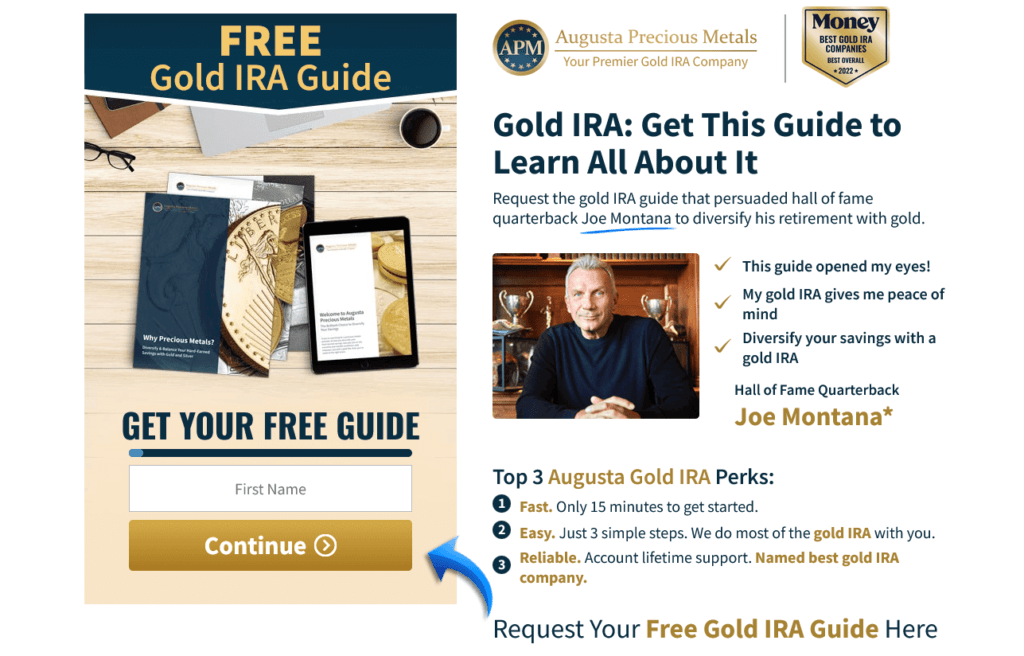

There are several companies that offer gold IRA investing. The key is to do research before you choose a provider. You can compare the services of different companies, as well as read customer reviews and this is crucial to find the best gold IRA provider.

If you don’t want to worry about taxes, you can invest in physical gold and other precious metals. However, there are strict IRS regulations regarding the type of gold you can invest in as gold must be at least 99.5% pure in order to be deemed safe and tax-free and you should only invest in gold coins or bullion if they meet these guidelines.

Another important point about a gold IRA is that you don’t pay taxes on the growth of your account or on any distributions made from it. However, you have to make sure that you keep the money in the account until you are eligible to withdraw it. A gold IRA is a good choice for those who want to diversify their portfolios and it can also be a wise move if you want to avoid the volatility of the stock market.

There are some fees involved with a gold IRA. There is an initial account setup fee and annual account maintenance fees. You also have to pay depository fees and insurance for the gold you store.

Tax-deferred growth of a Self Directed Gold IRA

One of the primary benefits of investing in gold is that you will never have to pay taxes on the value of your investment. This is because it is considered to be a safe investment and there are no government devaluation policies that can affect the value of your investments. You can contribute as much money as you want to your gold IRA account and it will grow tax-deferred. This is a great feature if you plan on using your gold IRA for your retirement .

Gold IRA accounts are tax-deferred investment vehicles that can be used to invest in precious metals. They allow you to invest in physical bullion rather than paper investments, which increases liquidity. This provides the freedom to choose the provider you want to work with. If you are interested in investing in gold, you should consider using an account with an accredited investment gold ira company. You can find reputable companies with A+ ratings on the Better Business Bureau and 4.9/5.0 stars on Trustpilot. It is important to ensure that you work a company that is committed to providing quality service and transparent pricing. The process of opening a new account is simple and easy. You simply choose a provider, fill out an application, and make your first deposit.

One major benefit of Gold IRA investing is that you can roll over your retirement funds into a new account. This will allow you to continue making your contributions tax-free. This is great news for retirees who do not want to pay high taxes in retirement. And since you can withdraw your funds at any time, there is no penalty for rolling over your Gold IRA to another account.

The national debt is huge, and most people believe it will continue to grow. This has historically led to panic in global markets, and it is important to diversify your portfolio with physical assets such as gold to hedge against market fluctuations and protect your retirement.

In Summary

Gold is a valuable investment that can help protect your portfolio during times of economic instability. A gold IRA is a great way to add physical gold to your retirement savings. If you’re interested in investing in gold, we recommend taking a look at our review of the top three gold IRA companies. These companies offer low-cost gold investments and excellent customer service.